What exactly is car insurance?

Because car insurance is not a tangible product, some consumers have a hard time understanding what exactly they are paying for. When you buy car insurance, you are purchasing a policy from an insurance company. The premium you pay buys you that policy, which insures a certain amount of coverage in the event of an accident. In order to be able to pay out claims after an accident, the insurance company pools risk among all the customers they insure. The premiums collected from their whole customer base go toward the claims they pay when a customer incurs a loss.

How is my premium determined?

Insurance companies decide your premium amount based on several factors. Basically, there are certain levels of risk associated with various statistics—from age to where you live to your driving history. The insurance company assesses the probable risk of taking you on as a customer, and from there they determine your premium. Since teens are at higher risk of accidents, their insurance premiums are generally much higher than older adults.

While there are some risk factors you can’t control, like your age, there are several ways you can reduce your risk to insurance companies and lower your insurance rates. Some practical things you can do to lower your risk are:

- Maintain a clean driving record. Even a speeding ticket can affect your rate.

- Choose a vehicle with built-in safety features. Cars with certain security and safety features are statistically less likely to be involved in an accident or stolen, so insurance companies might offer a better rate for drivers of these cars.

- Park in the garage. Insurance companies often offer discounts for garage parked vehicles, as they are less likely to be stolen or involved in accidents.

Besides following these tips, it is also beneficial to shop around for your auto insurance. Compare policies and quotes from multiple companies to ensure you are getting the best rate and adequate coverage. Big name companies that do lots of advertising are not necessarily better than lesser-known companies.

How much car insurance am I required to carry?

States vary on the minimum amount of coverage drivers are required to carry. In California, drivers are required to carry the following, at a minimum:

- Bodily Injury Liability Coverage: $15,000 per person / $30,000 per accident

- Property Damage Liability Coverage: $5,000

Although these are the legal minimums in California, most insurance companies would rightfully recommend additional coverage. Carrying only liability insurance will leave you unprotected if you are at fault in a crash. Liability insurance also will not cover you if you are involved in a crash with an uninsured motorist.

What do the different types of insurance cover?

Liability coverage covers the other driver in a crash caused by you. Therefore, bodily injury liability coverage refers to the amount the insurance will pay out if you cause an accident that results in injury to the other party. Property damage liability covers property damage you cause in an accident.

Uninsured motorist coverage covers damage and injuries caused by an uninsured driver. Without this coverage, it can be difficult to recover compensation if you are hit by an uninsured driver. Considering that 1 in 8 drivers is uninsured, and another 30% are underinsured, uninsured motorist coverage is important.

You can also purchase collision coverage. This will help cover costs if you hit another vehicle or an object, such as a lamp post or guard rail. Comprehensive coverage covers damage from things other than an accident, such as vandalism, fire and flooding.

Medical expense coverage and personal injury protection are coverage options that will help pay for medical costs after an accident. Personal injury protection can pay for a wider range of costs, such as rehabilitation, work loss and funeral expenses.

As with other types of insurance, auto insurance policies have a deductible that must be met by the insured driver before the insurance will pay out. Be sure to check what the deductibles are on your policy. You might think you are getting a great deal on a policy with a low premium, but that might not be the case if you get into an accident and learn that you have a $1,000 deductible to pay.

What is the California Good Driver Discount?

A 20% discount on auto insurance is available to drivers in California who qualify for the Good Driver Discount. To qualify for the discount, a driver must have the following:

- The driver must have had a valid driver’s license for three consecutive years.

- The driver must have no more than 1 point on their driving record within the last three years. A minor violation, such as speeding, will add a point to your driving record.

- The driver cannot have any major violations on their driving record for the last 10 years. Major violations include offenses such as reckless driving and driving under the influence.

The California Good Driver Discount rewards drivers who follow traffic laws. Not only are you lowering your auto insurance rates, but you are helping make roads safer for everyone by practicing safe driving habits.

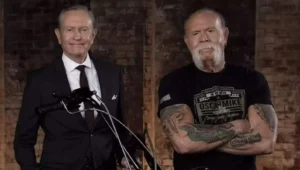

“Carrying the proper amount of auto insurance helps drivers avoid unnecessary hassles if they are involved in an accident,” said Attorney Walter Clark, founder of Walter Clark Legal Group.

Our firm has been handling personal injury cases throughout the California Low Desert and High Desert communities for over 30 years. With a 95% success rate, the California personal injury attorneys at Walter Clark Legal Group will fight to hold those responsible for your loss accountable and win compensation to cover medical bills, lost wages, and pain and suffering. If you have been injured in an auto accident and want to discuss your legal options, contact us today for a free consultation with an experienced personal injury lawyer. We have offices in Indio, Rancho Mirage, Victorville, and Yucca Valley and represent clients through the entire California Low Desert and High Desert communities.

DISCLAIMER: The Walter Clark Legal Group blog is intended for general information purposes only and is not intended as legal or medical advice. References to laws are based on general legal practices and vary by location. Information reported comes from secondary news sources. We do handle these types of cases, but whether or not the individuals and/or loved ones involved in these accidents choose to be represented by a law firm is a personal choice we respect. Should you find any of the information incorrect, we welcome you to contact us with corrections.

- What To Do If You Have Been Injured At A Concert In California? Mar 27,2024

- Walter Clark Legal Group Reimburses Thanksgiving Ride Fares Nov 14,2023

- Walter Clark Legal Group Donates Backpacks to Booker T. Washington Elementary School Aug 22,2023

- Walter Clark Legal Group Donates Backpacks to Underserved Students Aug 22,2023

- Walter Clark Legal Group Reimburses Labor Day Ride Fares Aug 21,2023

- 2023 Safe Ride Home Program Jun 21,2023