To some, auto insurance might seem like just another expense that doesn’t offer a very good return. It is easy to see someone might think that, particularly if they have never been in an accident before. However, car insurance is actually very important for every driver on the road.

As with any other insurance, car insurance protects you in the event that something happens to your vehicle. Considering there are about 10 million car accidents every year in the U.S.—from minor fender benders to multi-car collision—the chances that you will be involved in an accident at some point are fairly high. And if that does happen, you will want to be adequately covered with a good car insurance policy.

Here are 10 reasons why you should have a good auto insurance policy:

- You need insurance to legally drive your vehicle. Not having auto insurance can subject you to fines and the loss of your driver’s license.

- You need auto insurance to protect yourself in case you are liable in an accident. Accidents happen—sometimes, an accident might even be at least partially your fault. The more liability insurance coverage you have, the better protected you are in the event of an accident where you are at-fault. If you only have minimal liability coverage, you could end up being held liable for any damages a court awards the other party in excess of what your insurance will pay out. Having ample liability insurance will help protect you from owing thousands of dollars in damages if this ever happens to you.

- Insurance protects you in case you cause property damage. If you hit another person’s vehicle or property, such as a mailbox or house, you could be liable for those damages. Similarly, you can be held liable for damage you cause to city property, like a traffic sign. Your policy’s property damage liability coverage will kick in if this happens.

- Insure yourself against other types of damage with comprehensive coverage. Comprehensive coverage will pay out for damage caused by things like fire, storms and vandalism. Without it, you will have to pay for this damage yourself.

- Uninsured motorist coverage protects you from uninsured drivers. If you are involved in an accident caused by a driver who does not have auto insurance, your uninsured motorist coverage will help pay for your damages. Moreover, this coverage can also protect you if you are involved in an accident with a hit-and-run driver.

- Likewise, underinsured motorist coverage will help cover your expenses if the at-fault driver’s insurance is not enough to pay for your full damages. For instance, suppose the at-fault driver only carried $25,000 in liability coverage, but your damages are $50,000. If you carry at least $25,000 in underinsured motorist coverage, you would be able to claim that through your insurance company to cover the remainder of your damages.

- Adding on other coverage options can be inexpensive and might really save you in the long run. For instance, you can add gap coverage to your policy. This is important if you are still paying the loan on your vehicle and it ends up being totaled. Gap coverage can help pay the difference between what you still owe on the vehicle and what its actual cash value (ACV) is.

- Another optional coverage is Medical Pay Benefits, known as Med Pay. In California, this coverage is not required, but it can be a great help if you or anyone else in your vehicle is injured. Whether you or the other driver was at fault for the accident, Med Pay coverage will pay for you and your passengers’ reasonable and necessary medical bills.

- Other options can help with convenience and eliminating unnecessary hassles if you have been in an accident. These include things like roadside assistance and rental reimbursement.

- Having a good auto insurance policy with a reliable company you trust can make the unpleasant process after an accident much smoother. The insurance company should help walk you through the process of filing claims, finding the right repair shop and getting appropriate medical care.

As you can see, car accidents can result in many expenses. If you are not protected with adequate insurance, you could end up having to pay thousands of dollars out of pocket. A good auto insurance policy will help you hedge against this scenario, and offer you peace of mind when you’re behind the wheel.

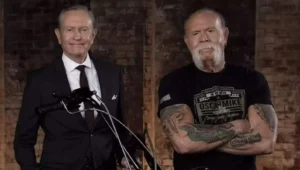

“We cannot stress the importance of a good car insurance policy enough. If you are unsure about your coverage, call your provider to find out what you have. Make that it is enough to protect you in the event of a serious accident,” said Attorney Walter Clark, founder of Walter Clark Legal Group.

Our firm has been handling personal injury cases throughout the California Low Desert and High Desert communities for over 30 years. With a 95% success rate, the California personal injury attorneys at Walter Clark Legal Group will fight to hold those responsible for your loss accountable and win compensation to cover medical bills, lost wages, and pain and suffering. If you have been injured in an auto accident and want to discuss your legal options, contact us today for a free consultation with an experienced personal injury lawyer. We have offices in Indio, Rancho Mirage, Victorville, and Yucca Valley and represent clients through the entire California Low Desert and High Desert communities.

DISCLAIMER: The Walter Clark Legal Group blog is intended for general information purposes only and is not intended as legal or medical advice. References to laws are based on general legal practices and vary by location. Information reported comes from secondary news sources. We do handle these types of cases, but whether or not the individuals and/or loved ones involved in these accidents choose to be represented by a law firm is a personal choice we respect. Should you find any of the information incorrect, we welcome you to contact us with corrections.

- What To Do If You Have Been Injured At A Concert In California? Mar 27,2024

- Walter Clark Legal Group Reimburses Thanksgiving Ride Fares Nov 14,2023

- Walter Clark Legal Group Donates Backpacks to Booker T. Washington Elementary School Aug 22,2023

- Walter Clark Legal Group Donates Backpacks to Underserved Students Aug 22,2023

- Walter Clark Legal Group Reimburses Labor Day Ride Fares Aug 21,2023

- 2023 Safe Ride Home Program Jun 21,2023