If you have been injured in an accident, you will need to work with the responsible party’s insurance company. The insurance company will want to investigate the accident to determine fault and decide how much compensation to offer you.

Part of this investigation will very likely include looking at your medical history. Usually the adjuster is looking for any preexisting conditions or injuries you might have.

Accessing Your Medical Records

If the insurance adjuster asks for your medical records, they might ask you to give them permission to request them from your doctor. You are not obligated to do this. Instead, you can request them yourself and review them before sending them over. You can decide which records are relevant to the accident and remove anything that does not pertain to those injuries.

What to Do if the Insurance Company Requests My Full Medical History?

While this should be enough for the insurance company, they might still ask for additional records to further investigate your medical history. At this point, you should consult with your personal injury attorney about what steps to take. Is the request reasonable or unnecessary? Your attorney can ask the adjuster why they believe the records are necessary. They might be able to work out a compromise that protects your privacy. If the disagreement results in an impasse, your case may have to go to trial. There, a judge can decide what records are necessary to the claim.

What About an Independent Medical Examination?

If you and the insurance company have serious discrepancies about the severity of your injuries that cannot be resolved through negotiations, the insurance company might request that you have an independent medical examination (IME). This does not happen often. However, when it does, understand that the insurance company chooses and pays the doctors that complete the exams. Because of this, they are far more likely to favor the insurance company. You are not obligated to submit to an IME, except in some cases when you are submitting a claim through your own insurance company. If the insurance company is insistent, it might be in your best interest to refuse. Your claim might then end up going to trial. Your attorney will help you determine the most favorable move for you.

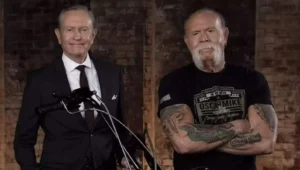

“Throughout this process, remember that the insurance company is looking out for their interests, not yours. Consult your attorney before agreeing to any requests from the insurance adjuster,” said Attorney Walter Clark, founder of Walter Clark Legal Group.

Our firm has been handling personal injury cases throughout the California Low Desert and High Desert communities for over 30 years. With a 95% success rate, the California personal injury attorneys at Walter Clark Legal Group will fight to hold those responsible for your loss accountable and win compensation to cover medical bills, lost wages, and pain and suffering. If you have been injured in an auto accident and want to discuss your legal options, contact us today for a free consultation with an experienced personal injury lawyer. We have offices in Indio, Rancho Mirage, Victorville, and Yucca Valley and represent clients through the entire California Low Desert and High Desert communities.

DISCLAIMER: The Walter Clark Legal Group blog is intended for general information purposes only and is not intended as legal or medical advice. References to laws are based on general legal practices and vary by location. Information reported comes from secondary news sources. We do handle these types of cases, but whether or not the individuals and/or loved ones involved in these accidents choose to be represented by a law firm is a personal choice we respect. Should you find any of the information incorrect, we welcome you to contact us with corrections.

- What To Do If You Have Been Injured At A Concert In California? Mar 27,2024

- Walter Clark Legal Group Reimburses Thanksgiving Ride Fares Nov 14,2023

- Walter Clark Legal Group Donates Backpacks to Booker T. Washington Elementary School Aug 22,2023

- Walter Clark Legal Group Donates Backpacks to Underserved Students Aug 22,2023

- Walter Clark Legal Group Reimburses Labor Day Ride Fares Aug 21,2023

- 2023 Safe Ride Home Program Jun 21,2023