California drivers are required to carry car insurance—but does that mean everyone follows the rule? Unfortunately, not everyone who gets behind the wheel in California has car insurance. In fact, the Insurance Research Council (IRC) says that about 1 in 8 drivers in the U.S. in 2015 was uninsured. In California, roughly 15% of drivers are estimated to be driving without insurance.

What Happens if an Uninsured Driver Hits You?

In addition to uninsured drivers, there is also the issue of underinsured drivers. California drivers are required to carry a minimum of $15,000 per person and $30,000 per accident of bodily injury liability coverage, and a minimum of $5,000 in property damage liability coverage. Carrying the minimum coverage is certainly better than being uninsured, that might not be enough to cover your damages if you are seriously injured in an accident.

What is Uninsured Motorist Coverage?

Uninsured motorist coverage covers damage and injuries caused by an uninsured driver. It is not a requirement for California drivers, but it is a good idea to have the coverage in the event of an accident with an uninsured or underinsured driver. Without this coverage, it can be difficult to recover compensation if you are hit by a driver who is uninsured or underinsured.

Here are a few things you should know about uninsured motorist coverage:

- It only covers you if you were not at fault for the accident.

- You are covered even if you are not driving a vehicle. If you are hit by an uninsured motorist while walking or riding a bike, you will still be covered.

- You must file a claim with your insurance company within two years.

- If you were hit by a driver who left the scene, it is imperative that you file a police report.

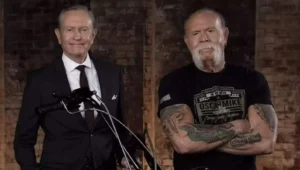

“There are roughly 4 million drivers in California who are driving without car insurance—and many more who are underinsured. In light of that, California drivers would be wise to consider carrying uninsured motorist coverage,” said Attorney Walter Clark, founder of Walter Clark Legal Group.

Our firm has been handling personal injury cases throughout the California Low Desert and High Desert communities for over 30 years. With a 95% success rate, the personal injury attorneys at Walter Clark Legal Group will fight to hold those responsible for your loss accountable and win compensation to cover medical bills, lost wages, and pain and suffering. If you have been injured in an auto accident and want to discuss your legal options, contact us today for a free consultation with an experienced personal injury lawyer. We have offices in Indio, Rancho Mirage, Victorville, and Yucca Valley and represent clients through the entire California Low Desert and High Desert communities.

DISCLAIMER: The Walter Clark Legal Group blog is intended for general information purposes only and is not intended as legal or medical advice. References to laws are based on general legal practices and vary by location. Information reported comes from secondary news sources. We do handle these types of cases, but whether or not the individuals and/or loved ones involved in these accidents choose to be represented by a law firm is a personal choice we respect. Should you find any of the information incorrect, we welcome you to contact us with corrections.

- What To Do If You Have Been Injured At A Concert In California? Mar 27,2024

- Walter Clark Legal Group Reimburses Thanksgiving Ride Fares Nov 14,2023

- Walter Clark Legal Group Donates Backpacks to Booker T. Washington Elementary School Aug 22,2023

- Walter Clark Legal Group Donates Backpacks to Underserved Students Aug 22,2023

- Walter Clark Legal Group Reimburses Labor Day Ride Fares Aug 21,2023

- 2023 Safe Ride Home Program Jun 21,2023